Key Partnerships

Shuaa Capital psc has established key partnerships with various entities to enhance its business operations and drive growth in the financial services industry. These partnerships play a crucial role in strengthening the company's market position and expanding its reach in the global market.

Strategic alliances with financial institutions:- Shuaa Capital psc has formed strategic alliances with leading financial institutions to offer a wide range of financial products and services to its clients. These partnerships enable the company to leverage the expertise and resources of its partners to drive innovation and deliver value-added solutions to customers.

- Through these partnerships, Shuaa Capital psc is able to access new markets and customer segments, increase its distribution channels, and enhance its product offerings. By collaborating with financial institutions, the company can tap into new opportunities and address the evolving needs of its clients effectively.

- Shuaa Capital psc has established collaborations with global investment firms to strengthen its investment capabilities and access new investment opportunities across various asset classes. These partnerships enable the company to diversify its investment portfolio, mitigate risks, and maximize returns for its clients.

- By collaborating with global investment firms, Shuaa Capital psc can leverage their expertise, networks, and research capabilities to identify lucrative investment opportunities and navigate complex market conditions. These partnerships also facilitate knowledge exchange and best practices sharing, which ultimately benefit the company and its clients.

- Shuaa Capital psc has forged partnerships with regulatory bodies to ensure compliance with regulatory requirements and uphold the highest standards of corporate governance. These partnerships help the company maintain transparency, integrity, and accountability in its operations, which are essential for building trust and credibility with stakeholders.

- By working closely with regulatory bodies, Shuaa Capital psc can stay ahead of regulatory changes, mitigate compliance risks, and respond proactively to regulatory challenges. These partnerships also demonstrate the company's commitment to regulatory compliance and responsible business practices, which are critical for its long-term sustainability and success.

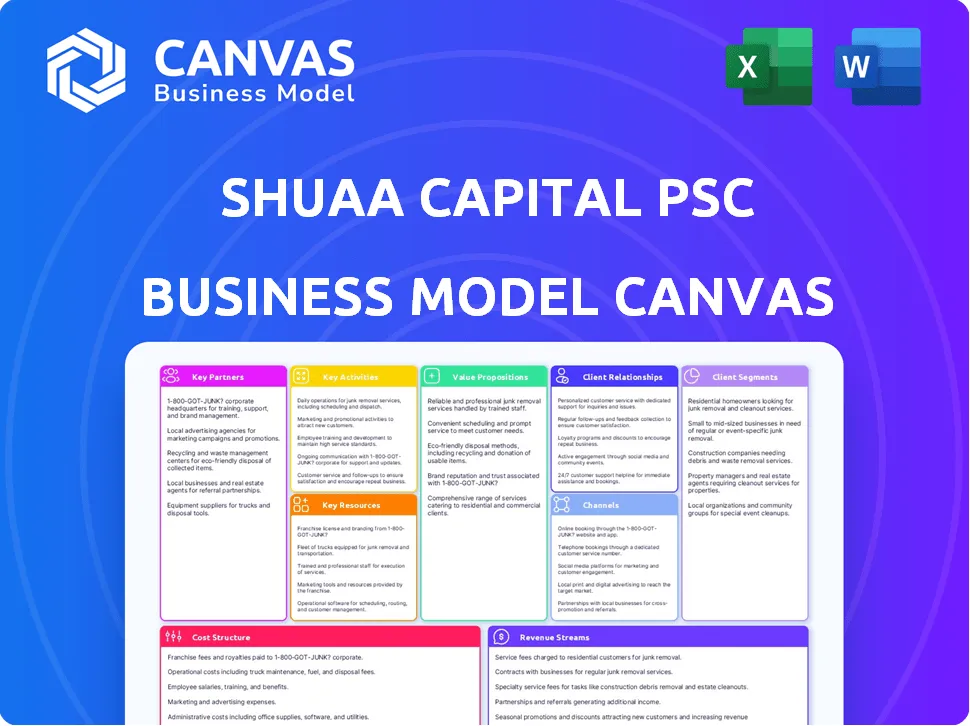

[cbm_canvas_top]

Key Activities

Shuaa Capital psc operates as a leading financial services firm in the Middle East, offering a range of services to meet the diverse needs of its clients. The key activities of the company include:

Asset management services:- Shuaa Capital psc provides expert asset management services to help individuals and institutions achieve their financial goals. This involves creating and managing investment portfolios tailored to the unique needs and risk profiles of each client. The company's team of experienced professionals conducts thorough market research and analysis to identify lucrative investment opportunities and make informed decisions on behalf of their clients.

- Shuaa Capital psc offers a comprehensive suite of investment banking solutions, including mergers and acquisitions, capital raising, restructuring, and advisory services. The company leverages its extensive network and expertise in the region to provide innovative and customized solutions that drive value for its clients. Whether it's facilitating corporate transactions or restructuring a company's capital structure, Shuaa Capital psc delivers strategic advice and execution support to help clients achieve their financial objectives.

- Shuaa Capital psc specializes in managing investment portfolios on behalf of clients, utilizing a mix of asset classes to optimize returns and mitigate risks. The company's portfolio management team applies a disciplined approach to asset allocation, diversification, and risk management to ensure that client portfolios are well-positioned to withstand market volatility and generate long-term growth. By staying abreast of market trends and utilizing sophisticated investment strategies, Shuaa Capital psc continuously seeks to maximize returns for its clients while maintaining a prudent level of risk.

Key Resources

Shuaa Capital psc relies on several key resources to effectively operate and excel in the financial industry. These essential resources include:

Experienced Financial Analysts:- One of the most valuable resources of Shuaa Capital psc is its team of experienced financial analysts. These professionals bring a wealth of knowledge and expertise to the table, allowing the company to make sound investment decisions and stay ahead of market trends.

- These financial analysts have years of experience in the industry and are well-versed in conducting thorough market research, analyzing financial data, and identifying lucrative investment opportunities.

- Another key resource of Shuaa Capital psc is its strong investment portfolio. This portfolio is made up of a diverse range of investments, including stocks, bonds, real estate, and more.

- By maintaining a well-balanced and diversified investment portfolio, Shuaa Capital psc is able to mitigate risk and maximize returns for its clients.

- Shuaa Capital psc also relies on advanced financial analysis tools to help inform its investment decisions. These tools include data analytics software, financial modeling tools, and market research platforms.

- By leveraging these advanced tools, Shuaa Capital psc is able to conduct in-depth financial analysis, identify emerging market trends, and make informed investment decisions that are in the best interest of its clients.

Value Propositions

Shuaa Capital psc stands out in the financial industry with its strong value propositions that cater to the unique needs of its clients. These value propositions are what sets Shuaa Capital psc apart from its competitors and solidifies its reputation as a trusted financial partner.

One of the key value propositions of Shuaa Capital psc is its expertise in asset management and investment banking. With a team of seasoned professionals who have in-depth knowledge and experience in these areas, clients can trust Shuaa Capital psc to provide expert advice and guidance on their investment portfolios. This expertise allows Shuaa Capital psc to offer tailored investment strategies that align with clients' financial goals and risk tolerance.

Another key value proposition of Shuaa Capital psc is its diverse and robust investment options. Clients have access to a wide range of investment products, including equities, fixed income securities, real estate, and alternative investments. This diverse offering allows clients to build a well-rounded portfolio that is tailored to their individual needs and preferences.

Additionally, Shuaa Capital psc provides customized financial solutions for clients. By taking the time to understand each client's unique financial situation and goals, Shuaa Capital psc is able to develop personalized financial plans that address their specific needs. Whether a client is looking to grow their wealth, save for retirement, or plan for their children's education, Shuaa Capital psc can create a customized solution that helps them achieve their financial objectives.

Overall, Shuaa Capital psc's value propositions of expertise in asset management and investment banking, diverse investment options, and customized financial solutions demonstrate its commitment to providing unparalleled service and value to its clients.

Customer Relationships

Shuaa Capital psc places a strong emphasis on building and maintaining long-lasting relationships with our clients. We understand that each client has unique investment goals and preferences, and we strive to provide personalized services to meet their individual needs.- Dedicated Account Managers: Each client is assigned a dedicated account manager who serves as their primary point of contact. Our account managers are highly knowledgeable about our products and services, and they work closely with clients to understand their financial goals and develop tailored investment strategies.

- Personalized Investment Advice: We believe in providing our clients with personalized investment advice based on their risk tolerance, investment goals, and financial situation. Our team of experts conducts in-depth analysis and research to recommend investment opportunities that align with each client's objectives.

- Ongoing Client Support and Consultation: Our commitment to our clients does not end after the initial investment. We offer ongoing support and consultation to help clients navigate market changes, assess portfolio performance, and adjust investment strategies as needed. Whether clients have questions, need guidance, or require assistance with portfolio management, our team is always available to provide timely and reliable support.

Channels

Shuaa Capital psc utilizes various channels to reach out to its clients and provide them with financial services. These channels include:

- www.shuaa.com official website: The company's official website serves as a primary channel for clients to access information about the services offered by Shuaa Capital psc, as well as to contact the company for inquiries or to schedule meetings.

- Direct client meetings: Shuaa Capital psc believes in the power of face-to-face interactions and thus regularly schedules direct client meetings to discuss their financial needs, offer personalized solutions, and build long-term relationships.

- Financial seminars and webinars: The company organizes and conducts financial seminars and webinars to educate clients on various investment opportunities, market trends, and financial planning strategies. These events serve as a platform for clients to interact with Shuaa Capital psc experts and learn about their services.

Customer Segments

Shuaa Capital psc primarily targets three main customer segments:

- Institutional investors: This segment includes large financial institutions, such as pension funds, insurance companies, and mutual funds. These investors typically have significant capital to invest and are looking for professional asset management services to help them achieve their financial goals.

- High net worth individuals: Shuaa Capital psc also caters to high net worth individuals who have substantial personal wealth. These individuals may be looking for personalized investment advice, wealth management services, and access to exclusive investment opportunities.

- Corporate clients: The third customer segment consists of corporate clients, including publicly traded companies, private companies, and government entities. These clients may require a range of financial services, such as mergers and acquisitions advisory, capital raising, and restructuring solutions.

By targeting these diverse customer segments, Shuaa Capital psc is able to meet the unique needs and preferences of each group, providing tailored financial solutions that help them achieve their investment objectives.

Cost Structure

Shuaa Capital psc operates with a detailed cost structure that encompasses various aspects of the business. These costs are essential for the smooth functioning and growth of the company.

Operational costs: A significant portion of Shuaa Capital's expenses is allocated towards operational costs. This includes staff salaries, office space rent, utilities, office supplies, and other miscellaneous expenses. The company employs a team of qualified professionals who are crucial for the success of its operations. Staff salaries account for a substantial part of the operational costs, as Shuaa Capital believes in compensating its employees competitively to retain top talent and ensure employee satisfaction.

Technology and software development: In today's digital age, technology plays a vital role in the success of any business. Shuaa Capital invests heavily in technology and software development to stay ahead of the curve and provide its clients with innovative solutions. This includes the development of proprietary software tools, custom financial models, and other technological solutions that enhance the company's service offerings.

Marketing and client acquisition expenses: To attract new clients and maintain relationships with existing ones, Shuaa Capital allocates a portion of its budget towards marketing and client acquisition expenses. This includes advertising, sponsorships, events, and other marketing initiatives aimed at increasing brand visibility and awareness. Client acquisition expenses cover the costs associated with acquiring new clients, such as sales commissions, client onboarding, and other related expenses.

Overall, Shuaa Capital's cost structure is designed to support its operations, technology development, and growth initiatives. By efficiently managing its costs and investments, the company aims to maximize shareholder value and deliver long-term sustainable growth.

Revenue Streams

Shuaa Capital psc generates revenue through various streams within its business model. These revenue streams are:

- Asset management fees: One of the primary revenue streams for Shuaa Capital psc is asset management fees. As a leading asset management firm, the company charges fees for managing and investing clients' assets. These fees are typically charged as a percentage of assets under management, providing a steady and predictable source of revenue for the company.

- Investment banking commissions: Another key revenue stream for Shuaa Capital psc is investment banking commissions. The company offers a range of investment banking services, including mergers and acquisitions, capital raising, and financial advisory. Shuaa Capital psc earns commissions on these transactions, which can vary based on the size and complexity of the deal.

- Performance-based incentives: In addition to asset management fees and investment banking commissions, Shuaa Capital psc also generates revenue through performance-based incentives. These incentives are tied to the performance of the investments made on behalf of clients. If the investments outperform certain benchmarks or targets, Shuaa Capital psc may be entitled to additional compensation, providing an additional source of revenue for the company.

[cbm_canvas_bottom]