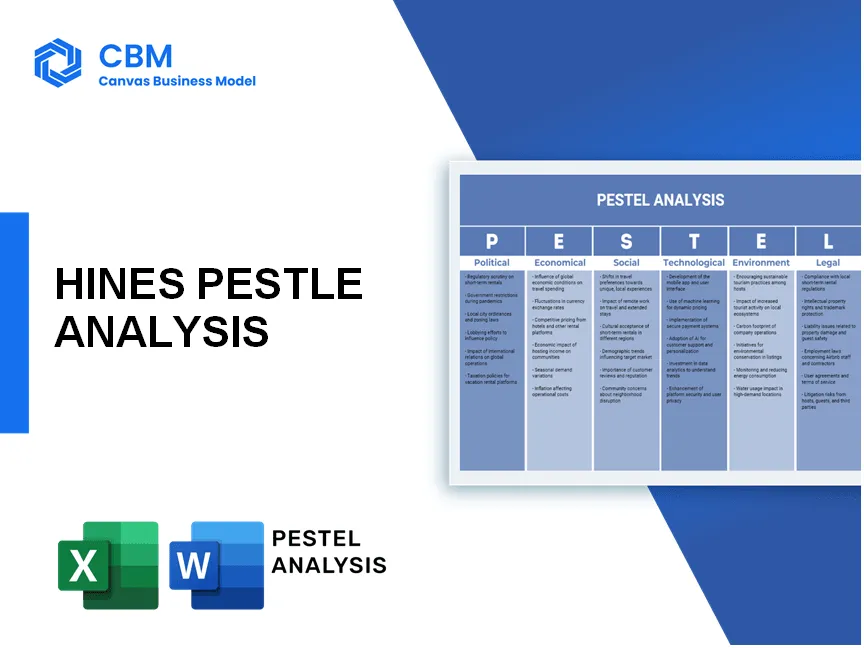

In a rapidly evolving market, Hines, a global real estate investment firm, stands at the crossroads of opportunity and challenge. Understanding the multifaceted influences shaping the industry is crucial. This blog post delves into the political, economic, sociological, technological, legal, and environmental factors—collectively known as the PESTLE analysis—that impact Hines' strategies and operations. From navigating complex regulations to responding to demographic shifts, discover how these forces drive innovation and shape the company's future. Read on to explore each dimension in detail!

PESTLE Analysis: Political factors

Influence of government policies on real estate development

Government policies significantly influence real estate development through regulatory frameworks, tax incentives, and funding opportunities. For instance, the U.S. Federal Housing Administration (FHA) insures loans worth approximately $1.3 trillion annually, promoting the construction of affordable housing.

Impact of zoning laws and land use regulations

Zoning laws and land use regulations determine how properties can be developed and utilized. In cities like New York, the zoning resolution has over 1,000 pages, affecting millions of square feet of real estate. In Los Angeles, zoning changes have unlocked the potential for 300,000 housing units as part of recent legislative efforts.

| City | Zoning Changes | Projected Housing Units |

|---|---|---|

| New York | Over 1,000 regulations | N/A |

| Los Angeles | New Housing Initiative | 300,000 |

| Houston | No formal zoning | N/A |

Stability of political environment in various regions

The stability of the political environment affects investor confidence and the overall real estate market. According to the Global Peace Index 2023, regions like North America and Western Europe rank high in political stability, while Middle Eastern countries often face fluctuations that impact investment. A stable environment can increase investment by up to 25%.

Trade agreements affecting investment opportunities

Trade agreements can either limit or enhance investment opportunities. The USMCA (United States-Mexico-Canada Agreement) facilitates trade and investment protection in North America, estimated to generate an additional $68 billion in economic activity across the member countries.

Public-private partnerships in infrastructure projects

Public-private partnerships (PPPs) play a critical role in funding infrastructure projects. In the United States, PPPs have financed over $100 billion in projects, with a significant focus on transportation and urban development. Notable examples include the Port of Miami Tunnel project financed through a PPP for approximately $600 million.

[cbm_pestel_top]

PESTLE Analysis: Economic factors

Fluctuations in interest rates impacting real estate financing

The Federal Reserve's interest rates have fluctuated significantly. As of September 2023, the Federal Funds Rate was at 5.25% to 5.50%. This marks a steep increase from the 0.00% to 0.25% range seen in early 2022, impacting borrowing costs for real estate financing.

Economic growth influencing demand for commercial properties

The U.S. GDP experienced a growth rate of 2.1% annually in the second quarter of 2023. This growth has been correlated with a more robust demand for commercial real estate, evidenced by a rise in net absorption rates:

| Property Type | 2021 Net Absorption (in million sq ft) | 2022 Net Absorption (in million sq ft) | 2023 Net Absorption (in million sq ft) |

|---|---|---|---|

| Office | 45 | 35 | 25 |

| Retail | 25 | 20 | 35 |

| Industrial | 90 | 102 | 110 |

Impact of inflation on construction costs and rental prices

In 2023, the consumer price index (CPI) showed an increase of 3.7% year-over-year, contributing to higher construction costs. According to the Bureau of Labor Statistics, construction inputs saw a nearly 12% rise in prices from 2021 to 2023. Rental prices have similarly risen, with a national increase of approximately 4.5% observed in multi-family rental units in 2023.

Availability of capital for real estate investment

The current market for commercial real estate investment saw a total transaction volume of approximately $805 billion in 2022, a decrease from $982 billion in 2021 due to tightening financial conditions. As of mid-2023, capital availability measured by commercial mortgage-backed securities saw a contraction of about 23% from the previous year.

Currency exchange risks in international investments

Hines operates in various international markets where currency fluctuations pose risks. For instance, the Euro was valued at approximately 1.07 USD in September 2023, compared to 1.20 USD in early 2022. This 10.8% depreciation impacts the valuation of investments denominated in euros when converted to USD.

PESTLE Analysis: Social factors

Sociological

Changing demographics affecting housing needs and preferences

The United States Census Bureau reported that by 2020, the population of people aged 65 and older is expected to reach 80 million, doubling from 40 million in 2010. This demographic shift necessitates the development of age-friendly housing solutions. Additionally, around 70% of this group expressed a preference for living in communities where services are easily accessible.

Urbanization trends driving demand for mixed-use developments

As per the United Nations, more than 55% of the global population currently resides in urban areas, a figure projected to exceed 68% by 2050. This urban growth is fueling the demand for mixed-use developments, with the global mixed-use development market size valued at $20.9 billion in 2020 and expected to grow at a CAGR of 5.5% by 2027.

Increasing focus on community-centric projects

According to a report from the Urban Land Institute, 82% of millennials prefer to live in walkable communities with access to public transportation and amenities. Hines has been increasingly investing in projects that promote a sense of community, which has shown to boost property values by 10-15% in certain markets.

Shifts in work habits, such as remote work influencing office space demand

Data from Global Workplace Analytics indicated that as of 2022, approximately 30% of the American workforce is engaged in remote work. This trend is leading to a rethink of office spaces, with companies looking to downsize or reconfigure their environments. Hines reported a 20% decrease in demand for traditional office space in urban areas as companies adapt to hybrid work models.

Growing interest in affordable housing solutions

According to the National Low Income Housing Coalition, there is a shortage of over 7 million affordable rental homes for extremely low-income renters. In 2021, Hines committed to investing $1 billion in affordable housing projects over the next five years, reflecting the pressing need for more budget-friendly housing options.

| Statistic Category | Data |

|---|---|

| Population Aged 65 | 80 million by 2020 |

| Urban Population Growth | 68% by 2050 |

| Global Mixed-Use Market Size (2020) | $20.9 billion |

| Millennials Preference for Walkable Communities | 82% |

| Remote Workforce Percentage | 30% |

| Affordable Rental Housing Shortage | 7 million homes |

| Hines Investment in Affordable Housing | $1 billion over five years |

PESTLE Analysis: Technological factors

Advancements in construction technology improving efficiency

The construction industry has seen significant advancements in technology, particularly with the adoption of Building Information Modeling (BIM). According to McKinsey, the use of BIM can lead to a 20% reduction in construction costs and a 15% improvement in project delivery time. Additionally, robotic technology and prefabrication methods have been gaining traction, aiming for efficiency increases up to 30% in labor productivity.

Use of AI and data analytics for market trend analysis

AI-enabled analytics are transforming how real estate firms assess market trends. The global AI in the real estate market size was valued at approximately $1.1 billion in 2020 and is expected to grow at a CAGR of 26.7% from 2021 to 2028. Hines utilizes predictive analytics to determine property values more accurately, achieving up to 90% accuracy in forecasts.

Increasing reliance on proptech for property management

Property technology (proptech) is increasingly reshaping property management practices. According to a report by PwC, investment in proptech reached approximately $32 billion in 2020, representing significant adoption rates in property management solutions. Hines integrates proptech solutions to reduce operational costs by an estimated 25% through automation and enhanced tenant engagement.

Integration of smart building technologies in developments

Smart building technologies are revolutionizing the management of real estate assets. Currently, buildings equipped with smart technologies can reduce energy consumption by up to 30%. Furthermore, studies show that smart buildings can increase asset value by as much as 20% when compared to traditional buildings. Hines has invested in numerous smart building projects, reflecting a broader commitment to sustainability and efficiency.

Cybersecurity concerns in digital property operations

As real estate transactions and operations become increasingly digital, cybersecurity has emerged as a major concern. In 2021, it was reported that cyberattacks in the real estate sector increased by 50%, highlighting vulnerabilities in property management systems. Hines has allocated approximately $2 million annually toward enhancing cybersecurity measures to protect sensitive tenant information and operational data.

| Technology | Impact on Efficiency | Investment Size |

|---|---|---|

| Building Information Modeling (BIM) | 20% reduction in costs | N/A |

| Artificial Intelligence | 90% accuracy in forecasts | $1.1 billion (2020 market size) |

| Proptech Solutions | 25% reduction in operational costs | $32 billion (2020 investment) |

| Smart Building Technologies | 30% reduction in energy consumption | N/A |

| Cybersecurity | N/A | $2 million (annual investment) |

PESTLE Analysis: Legal factors

Compliance with real estate laws and regulations

The real estate sector is governed by various local, state, and federal laws, including regulations related to zoning, building codes, and property transactions. Hines must comply with the following major regulations:

- Fair Housing Act, which applies nationwide and prohibits discrimination in housing.

- The Dodd-Frank Wall Street Reform and Consumer Protection Act, which impacts financial transactions associated with real estate.

- Various state-specific real estate license laws, which can range from $200 to $1,000 for licensing fees, depending on the state.

Impact of property rights and landlord-tenant laws

Property rights are essential to Hines' operations. Significant legal frameworks that must be observed include:

- Uniform Residential Landlord and Tenant Act, applicable in numerous states, which outlines the rights and responsibilities of landlords and tenants.

- Landlord-tenant disputes accounted for approximately 30% of civil cases in U.S. courts, highlighting the potential for litigation.

Ongoing issues with environmental and safety regulations

Environmental regulations significantly impact real estate operations. Relevant laws include:

- Environmental Protection Agency (EPA) regulations concerning environmental assessments, which can incur costs ranging from $15,000 to $50,000 for due diligence.

- Occupational Safety and Health Administration (OSHA) regulations that may impose fines ranging from $13,000 to $130,000 per violation, emphasizing safety compliance.

Legal challenges in international real estate investments

Hines faces various legal issues in international markets, such as:

- Foreign Corrupt Practices Act (FCPA), which imposes strict regulations on international bribery.

- Geopolitical risks affecting property investment in regions like Asia and Europe, impacting overall investment returns.

- Cross-border investment disputes comprising 77% of alleged treaty violations, leading to arbitration costs averaging $8 million per case.

Changes in tax laws affecting real estate transactions

Tax legislation plays a critical role in real estate investments. Recent changes include:

- The Tax Cuts and Jobs Act (2017), which lowered corporate tax rates from 35% to 21%.

- Capital Gains Tax rates affecting real estate sales, which currently range from 0%, 15%, or 20%, depending on income levels.

- State and local tax changes, where average property tax rates can vary significantly, averaging approximately 1.1% of property value across the U.S.

| Regulation | Type | Impact |

|---|---|---|

| Fair Housing Act | Federal | Prohibits discrimination in housing. |

| Dodd-Frank Act | Federal | Regulates financial transactions. |

| Uniform Residential Landlord and Tenant Act | State | Guidelines for landlord-tenant relationships. |

| Environmental Protection Agency Regulations | Federal | Environmental assessments required, costs from $15,000 to $50,000. |

| OSHA Regulations | Federal | Fine ranges from $13,000 to $130,000 per violation. |

| Foreign Corrupt Practices Act | Federal | Regulates international bribery risks. |

| Tax Cuts and Jobs Act | Federal | Reduced corporate tax rate from 35% to 21%. |

PESTLE Analysis: Environmental factors

Emphasis on sustainable building practices and green certifications

Hines has incorporated sustainable building practices in its operations, committing to the goals aligned with the United Nations Sustainable Development Goals (SDGs). As of 2023, more than 90% of Hines’ projects are certified under green building standards, including LEED and BREEAM. The firm has completed the development of over 400 green projects covering approximately 50 million square feet globally.

Impact of climate change on real estate investments

According to a 2022 report by the Global Risk Institute, climate change risks could impact real estate values by as much as 20% by 2030 in at-risk areas. Hines has recognized this and has integrated climate risk assessment into its investment strategies, focusing on locations that are less vulnerable to extreme weather events. Hines has also reported that properties located in areas that have implemented climate-resilient practices can yield returns up to 30% higher than those that do not.

Regulatory requirements for energy efficiency in properties

As of 2023, various regions where Hines operates have introduced stricter energy efficiency regulations. For instance, New York City’s Local Law 97 mandates that buildings over 25,000 square feet reduce greenhouse gas emissions by 40% by 2030 and 80% by 2050. Hines proactively adheres to these regulations, making investments of nearly $300 million in energy upgrades across its portfolio to achieve compliance and enhance sustainability.

Increasing importance of environmental impact assessments

In 2023, Hines completed over 200 environmental impact assessments for new development projects. This represents a 25% increase compared to previous years, reflecting heightened scrutiny from regulators and community stakeholders. Moreover, these assessments have become integral in planning stages, influencing design and thereby mitigating adverse environmental effects.

Community demands for eco-friendly development initiatives

Community feedback has increasingly favored eco-friendly development, with surveys indicating that over 70% of residents in urban areas prioritize sustainability in real estate developments. Hines has responded by enhancing community engagement initiatives, developing projects with green roofs, renewable energy sources, and sustainable landscaping. Recent data shows that projects meeting these community demands result in 30% faster lease-up rates than traditional developments.

| Factor | Green Certifications | Climate Change Impact | Energy Efficiency Regulations | Environmental Assessments | Community Preferences |

|---|---|---|---|---|---|

| Sustainable Practices | 90% of Projects Certified | Up to 20% Value Impact by 2030 | $300 million Investment for Compliance | 200 Assessments in 2023 | 70% of Residents Prefer Eco-Friendly |

| Green Building Projects | 400 Projects Completed | 30% Higher Returns in Resilient Areas | 40% Reduction by 2030 (NYC Law) | 25% Increase in Assessments | 30% Faster Lease-Up Rates |

In conclusion, navigating the multifaceted landscape that affects Hines requires a nuanced understanding of political, economic, sociological, technological, legal, and environmental factors. By staying attuned to shifting demographics, market trends, and regulatory changes, Hines can strategically position itself to harness opportunities and mitigate risks. This comprehensive PESTLE analysis not only highlights the challenges that the firm may face but also underscores the potential for growth and innovation in a rapidly evolving real estate market.

[cbm_pestel_bottom]